finance

Why The Hard Things To Do Are The Right Things To Do

We’re obsessed with success stories. We love to read about the latest IPO or overnight success and dream about it. We say “why can’t that happen to me?” while we sit on our couch covered in Doritos Locos Taco crumbs, getting annoyed when Netflix asks “are you still there?” Of course I am Netflix, now get on with the next episode of Parks and Rec.

Between episodes we look at our Facebook or Instagram feed and see our friends climbing a mountain or sitting on a beach somewhere. “Don’t they ever work? They got really lucky to get the job they have.” The last trip we took was to Iowa last year for a friend’s wedding, which was also the last time we negotiated a 3% raise at work.

Why do we expect extraordinary results when we’re doing the same ordinary things as everyone else?

[INFOGRAPHIC] Get free flights faster with the best airline programs and credit cards

“Frequent flyer programs take too long to earn free flights”

When I talk to friends about signing up for airline rewards programs and credit cards, the #1 concern I hear is “it takes too long to get enough points for free flights. It’s not worth it.” The funny part is that I completely agree – if it were up to me I’d get enough points every day and I could fly free whenever I want! I’d be on a plane to Buenos Aires right now. You can come too if you want.

Are you ready to earn quicker free flights? Read on.

Luckily there are people out there who will do all of the hard work for us and tell us exactly how to maximize our travel out of the goodness of their hearts. That’s what I’ve done with the Millennial’s Guide to World Travel. How to get travel for half the points? The best ways to rack up rewards points? It’s all in there.

The good news is that I’m not the only one with experiences and ideas, so here are a couple more to help you out!

What a layover in LAX taught me about learning from mistakes

A couple weeks ago I was on my way to San Francisco for a long weekend with some friends from college. I had just seen Foster the People at Red Rocks the night before and had an awesome time, but that late night wasn’t helping my early morning layover in LAX.

As soon as I landed I immediately found some coffee and a bagel to nurse before my next flight. I took a sip and settled down into an airport seat between a touchy couple and a teenager screaming into her phone. With an hour to spare I pulled out my phone and checked a few emails.

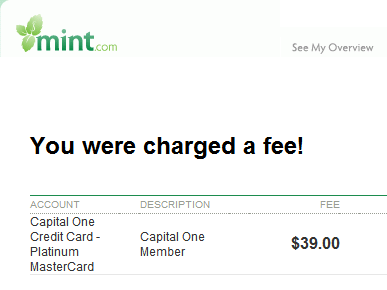

What’s this? I got an interesting email from Mint, the financial analysis service. I had just received a $40 fee on one of my credit cards. That’s a pretty sweet way to start a vacation.

The sad part is that the card that got charged is one that I don’t even use for anything besides length of credit history. $40 for a card with a small credit limit that I only pay my gym membership with… sweet. I looked into it and found out it was a $40 annual fee that I had already been paying for a few years without even knowing it. On the outside I was calm, collected Max but on the inside I was Frank Costanza.

https://www.youtube.com/watch?v=auNAvO4NQnY

Three Essential Steps to Saving Thousands by Improving Your Credit Score with Credit Cards

The other day I called my bank on the way to work and asked for credit limit increases on a couple of my credit cards. This isn’t because I need to spend more, but because it’s a smart financial decision to improve my credit score.

Lenders use credit scores for lots of things, but mainly when applying for a mortgage or auto loan. Although I won’t be buying a house in the next year or so, asking for credit limit increases on your cards is a solid move to make early and often. To understand why, let’s:

- Talk about what a credit report is and who uses it,

- What factors affect your credit score and,

- How to improve it so that, when you are ready to buy a house, you’re able to get the best rate possible.

How to Pick (and Manage) Credit Cards for the Best Travel Rewards - featured on Lifehacker: Two Cents

Photo Credit: 401kcalculator.org

Note: this article was featured on Lifehacker’s finance sub-blog Two Cents here!

Everybody loves to visit foreign countries and exotic lands, but it can be tough to save up for the travel that you’d like to do. Luckily, credit card miles are a great way to find your way to Europe for the trip you’ve always wanted.

Rewards credit cards aren’t for everybody. If you carry a balance on your credit cards, tend to overspend with credit or don’t have great credit history you may want to hold off on rewards for now. Instead, focus on breaking the paycheck-to-paycheck cycle and revisit this later. If you pay off your credit cards each month, have good credit history or get expenses reimbursed through work you might want to consider rewards cards.

This guide will help you choose the right cards, learn some strategies to earn extra points, and figure out how to best manage multiple credit cards responsibly.